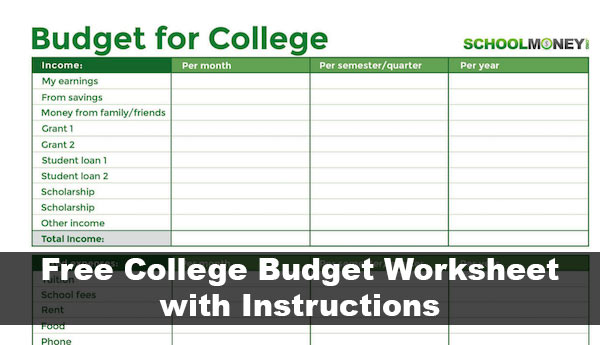

Free SchoolMoney Printable College Budget Worksheet with Instructions

Learning to budget your money in college can be a huge adjustment for many students, and knowing exactly where your money is coming from and where it’s going can make a big difference in your ability to make ends meet.

By looking at your finances from a holistic perspective, you will get a more specific sense of your financial state and where reductions in spending should take place. To help you in your financial planning, we’ve put together a fairly simple-to-use college budget worksheet, and in this article, we’ll take a look at how to use it.

>> Download your school money college budget worksheet here.

To get a good grasp of your financial health, you will need to break down your finances into three categories: income, fixed expenses, and flexible expenses. Here’s a description of each section included on the college budget worksheet, and the categories listed within those sections.

Income:

Income should include a comprehensive list of money you receive in all forms, including:

- Earnings from part-time or full-time work – If you are working a job with variable hours, then try to include your best estimate based on average earnings (or anticipated average hours per month in the future). For budgeting purposes, it’s a good idea to go with a conservative estimate. For instance, if you normally earn about $1200/month in part-time work, but one month you happened to pick up a lot of extra shifts and made $2200, it might be better to go with $1200 for your monthly earnings to be safe.

- Money from savings – You can look at this either as money you regularly pull from your savings account on average per month/semester/year, or money at your disposal should you need it. This can include money from your personal savings account or from a 529 college savings plan to cover education expenses such as tuition or textbooks.

- Money from family/friends – Include any money you currently receive, or any expenses paid for by friends/family even if they don’t directly give the money to you (for example, if your parents pay for your cell phone plan, car insurance, or health insurance premiums).

- Grant money – This would be any federal, state, or institutional money you are eligible for as indicated on your financial aid statement.

- Student loans – Include any amount of money you receive or plan to receive in form of federal or private student loans.

- Scholarships – Include any scholarship amounts you have been awarded only, not the ones you have applied for but haven’t heard back on yet.

- Other income – Be sure to include any money that doesn’t fall into these other categories here, such as housing stipends, tuition credit from work-study programs, etc.

Fixed Expenses:

Fixed expenses include any expenses you incur that don’t typically fluctuate much on a monthly/quarterly/annual basis. As mentioned above under the “money from family/friends” section, be sure to include the total amounts for each of these categories below, even if you don’t directly pay for them yourself.

If you have a family or friend covering these expenses for you, then include that amount as well above in the “money from family/friends” section. For example, if your cell phone bill is $50, but your parents cover that amount, then include $50 below under “phone” but then also add $50 to the “money from family/friends” section. Although it may seem redundant to include these amounts when you aren’t actually paying for them, the reason for doing so is to give you a comprehensive look at your finances and help you keep track of where money is coming from and where it’s being spent as a proactive approach. If you happen to fall off a parent’s car insurance plan, for instance, then you will roughly know what you should expect to pay for your own coverage.

- Tuition and school fees – You should be able to find this information on your institution’s website. If you are only going to school part-time, then do your best to estimate how many credits you plan to take per semester/quarter, and then use that number to calculate your monthly and annual totals.

- Rent – Include the full amount of your rent charges (do not account for any housing stipends you receive; instead, include that as income in the section above under “other income”).

- Food – This should be the amount you spend either on groceries or on your institution’s cafeteria meal plan.

- Phone

- Utilities – Include all housing-related expenses such as water, heat, electricity, gas, garbage, recycling.

- Cable/internet

- Health insurance – Include the amount you (or a parent pay) in health insurance premiums, which would likely either be deducted from your paycheck if covered by an employer, or paid to your school along with tuition and student fees.

- Car payment

- Car insurance

- Other fixed expenses – Include anything other expenses you can think of that don’t fall into any of these categories above.

Also read: 4 Clever Tricks That Will Help You Save Money When Studying Abroad

Flexible Expenses:

Flexible expenses include any expenses that can fluctuate to some degree on a monthly/quarterly/annual basis (again, even if you don’t directly pay for these yourself).

- Books/textbooks – If you purchase books/textbooks from your college bookstore, consider looking online for used copies to reduce your expenses.

- Medical/dental – This does not include health insurance premiums. Instead, include any out-of-pocket expenses incurred for medical or dental services, which are more variable and unpredictable. Try your best to capture a monthly/quarterly/annual average looking back on the last 12 to 24 months. If your medical/dental bills are covered by your parents, then ask them for that information from bill statements.

- Entertainment – Going to the movies, movie rentals, concerts, ticketed events, or any other form of entertainment are expenses you should list here.

- Eating out – Include an estimate of total amount you pay for food that is not prepared at home or covered under your institution’s meal plan.

- Clothing

- Sports – Include an estimate of the amount you spend to participate in or enjoy sporting events.

- Hobbies – This can include arts & crafts, music lessons, video games, or any other activity you are involved in to pass the time.

- Other – For anything that doesn’t fall into these categories above.

Determining Your Overage/Shortage:

Once you have determined your amounts for each category, you will be able to determine your total income, fixed expenses, and flexible expenses. On the bottom of the college budget worksheet, you’ll find a table where you can input those numbers. By subtracting your total fixed and flexible expenses from your total income, you will be able to determine your total overage or shortage.

An overall overage is a good thing, and indicates that you have a safety net of positive cash flow. If you do have an overage, then perhaps you can consider reducing the amount of student loans you receive, or putting extra money into savings while you can, in case one of these categories dramatically increases in the future.

On the other hand, if you have an overall shortage, then this indicates a negative cash flow and the need for you to look for ways to reduce your expenses and/or increase your income. In our articles “How to Save Money While in College” and “How to be Financially Responsible in College,” we outline some advice for making good financial decisions as a college student.

Hopefully you will be able to use this college budget worksheet and information offered in this article to boost your financial wellbeing. What are some creative ways you’ve found to save money and cut expenses in college? Let us know in the comments below!